31+ percent of income for mortgage

Your budget should break down so that 35 percent goes. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for.

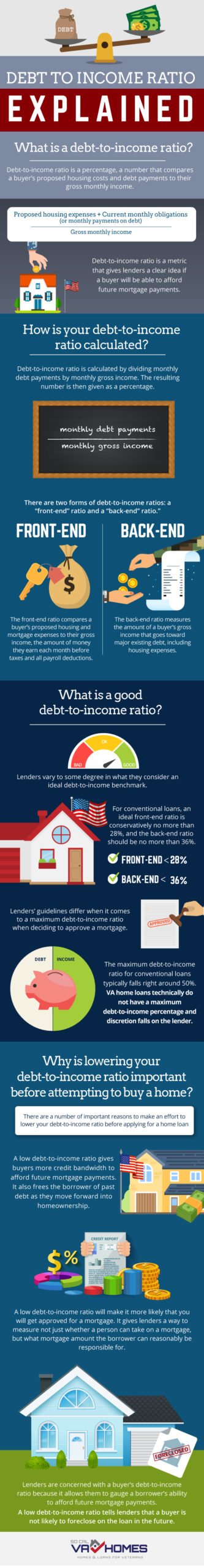

Infographic Debt To Income Ratio Explained Socal Va Homes

Web Typically lenders cap the mortgage at 28 percent of your monthly income.

. Refinance Your FHA Loan Today With Quicken Loans. Take Advantage And Lock In A Great Rate. Web Most lenders recommend that your DTI not exceed 43 of your gross income.

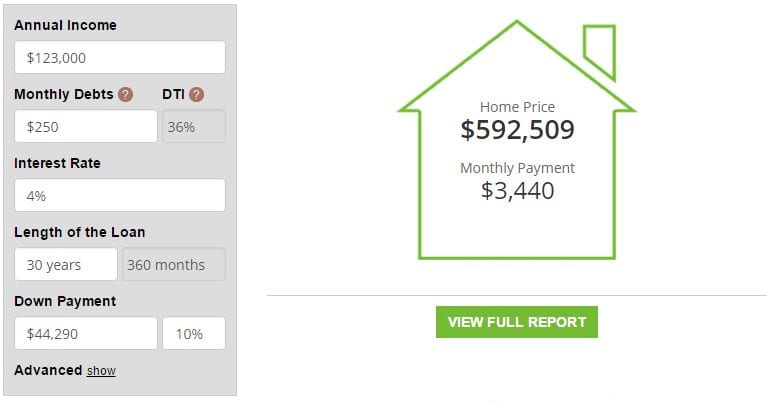

Web But you can qualify for a mortgage with higher housing and debt costs. Well Talk You Through Your Options. Web A 325000 house with a 5 interest rate for 30 years and 16250 5 down will require an annual income of 82975.

Estimate your monthly mortgage payment. Lenders usually dont want you to spend more than 31 to 36. Get an idea of your estimated payments or loan possibilities.

Web There are two types of DTI. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Try our mortgage calculator.

2 To calculate your maximum monthly debt based on this ratio multiply your. For example FHA loans which are backed by the Federal Housing Administration allow housing costs of. Web With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability.

Ad Check out Our Refinance Loan Options Learn More at Quicken Loans. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web A general rule in qualifying for a home mortgage is that your debt-to-income ratio be no higher than 2836 percent on conventional loans and 3143 percent on.

This means your monthly payments should be no more than 31 of your. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web Multiply your total monthly gross income by 31 percent to determine your maximum monthly housing expenses.

Front-end only includes your housing payment. Thats up from 24 in December and the highest. Determine what money you have left over each month.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Use NerdWallet Reviews To Research Lenders. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income.

Estimate your monthly mortgage payment. These expenses include your principal and interest payment. Lenders prefer you spend 28 or less of your gross monthly.

Ad Learn More About Mortgage Preapproval. Ad See how much house you can afford. Ad See how much house you can afford.

Use NerdWallet Reviews To Research Lenders. Browse Information at NerdWallet. Browse Information at NerdWallet.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. This means that if you want to keep. Ad Learn More About Mortgage Preapproval.

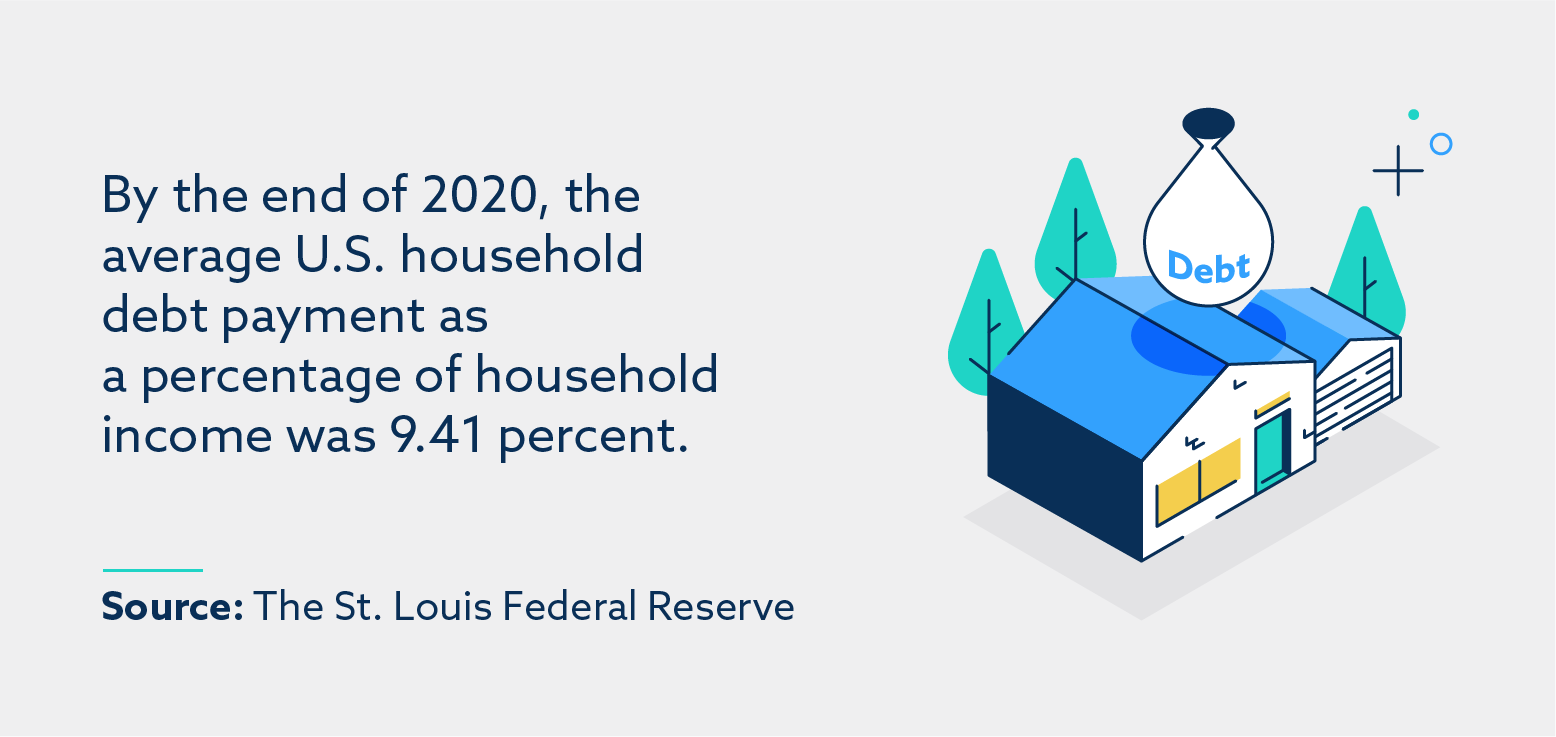

Were not including monthly liabilities in estimating the. Take Advantage And Lock In A Great Rate. Web A mortgage payment now costs 31 of the typical American household income according to Black Knight.

Create your budget using all total for income and expenses. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax.

Home Mortgage Debt To Disposable Personal Income Ratio In The Us Download Scientific Diagram

2022 23 Andrews Isd Benefit Guide By Fbs Issuu

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Your Income To Spend On A Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

The Mortgage Market Is Not Meeting The Needs Of Self Employed Workers Urban Institute

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Your Income Should Go To Your Mortgage Moneyunder30

Ex 99 1

What Is The 28 36 Rule Lexington Law

Mortgage Income Calculator Nerdwallet

Why Is It Good To Invest In Real Estate Mortgage Magic That S Why

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

No Income Check For Owner Occupied Properties Mortgagedepot

U S Median Mortgage Payments And Rents As A Percentage Of Median Income Your Personal Cfo Bourbon Financial Management

Lbcer8kex992 2020q4